MEDICARE EXPLAINED

Medicare is a federal health insurance program that aims to help US citizens with their health care expenses. It offers several plans designed to fulfill the different needs of seniors.

Who is eligible to enroll in a Medicare Plan?

As an agent, you’ll advise seniors, i.e., people older than 65 years of age, about the different parts of Medicare. For those who are not agents but want to enroll, here are the conditions for eligibility that you must meet to get Medicare:

Be 65 or olde

Or, be under 65 but have some disability or illness

Require a kidney transplant or regular dialysis due to permanent kidney failure

Have ALS, Lou Gehrig’s disease, or ESRD

However, those under age 65 can also take advantage of Medicare under certain conditions. They could:

Be receiving social security disability benefits

Have ALS or Lou Gehrig’s disease

Be the spouse of someone who’s 65 and older and already on Medicare

An agent must also help seniors be aware of the Medicare enrollment periods that are available. Without providing this information, it’s possible that anyone who has to enroll in Medicare could enroll later than what they should, which would result in late enrollment penalties.

The enrollment periods you need to discuss with your clients include:

Initial Enrollment Period

General Enrollment Period

Special Enrollment Period

Annual Enrollment Period

Medigap Open Enrollment Period

What does Medicare cover?

Medicare plans are divided into four different categories: Part A, B, C, and D. And, whether you are an agent or a client, it is important to know the differences between each part so the correct coverage decisions can be made.

Original Medicare (Part A & B)

Original Medicare comprises Part A – Hospital Insurance and Part B – Medical Insurance. People who want to add drug coverage to their Original Medicare plan can add on Part D.

A Medicare Supplement (Medigap) can also be added alongside Original Medicare. This will provide coverage for any out-of-pocket costs not covered by Original Medicare, but do keep in mind that each Medigap plan differs in coverage.

It’s also important to note that with Original Medicare and a Medigap plan, you can visit any healthcare provider that accepts Medicare. Some Medigap plans will even provide coverage for foreign travel emergency expenses.

Medicare Advantage (Part C)

This plan includes Part A, Part B, and additional benefits like dental, hearing, and vision coverage. Some Medicare Advantage plans also include Part D coverage.

Part C typically has lower out-of-pocket costs than Original Medicare, as you can collaborate with providers to add more benefits to this plan.

Medicare Prescription Drug Coverage (Part D)

Part D of the Medicare plan cuts out-of-pocket expenses by providing exclusive coverage for prescription drugs. Part D provides coverage for at least two drugs in each class. However, they are required to cover nearly all drugs in these categories:

Immunosuppressants

Antidepressants

Antipsychotics

Anticancer

Anticonvulsants

HIV/AIDS drugs

Take the next step!

Whether you are an aspiring agent or a client who needs help better understanding all of your Medicare Options, Real Senior Management is your go-to agency. We are dedicated to providing our agents with the support they need to serve their clients and our clients the resources they need to better understand their Medicare options.

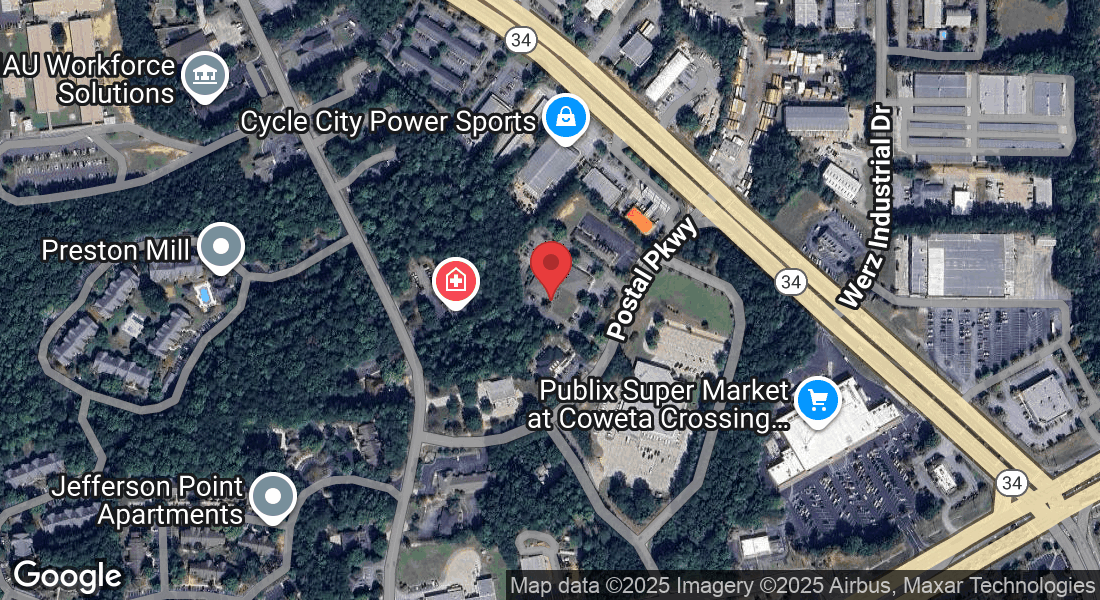

All you have to do is fill out the form below, call our office, or swing by to learn how we could help you!

Contact Us Today!

© 2026 All Rights Reserved.

Terms & Conditions | Privacy Policy

We are not connected with or endorsed by the United States government or the federal Medicare program. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.